Is 2026 a Good Year to Buy in the Bay Area? Here’s What the Data Actually Says.

If you’ve been waiting for the “perfect” time to buy a home in the Bay Area, you’re not alone.

Every year, buyers ask the same question:

“Should I wait?”

Headlines can feel dramatic. Interest rates shift. Inventory changes. Prices adjust. And it’s easy to feel stuck between wanting to make a smart decision and not wanting to miss out.

So let’s take a calm, clear look at what 2026 is really shaping up to be, without hype, fear, or pressure.

What the Bay Area Market Looks Like in 2026

While no one has a crystal ball, here’s what we’re seeing:

Inventory remains tighter than pre-2020 levels in many neighborhoods

Buyers are more strategic and less reactive than during peak frenzy years

Well-priced homes still move quickly

Overpriced homes are sitting longer

Interest rates are stabilizing compared to previous volatility

In short:

The market is more balanced than it was during extreme bidding-war seasons — but strong homes are still competitive.

That’s not a crash.

That’s not a boom.

That’s a maturing market.

Myth: “I Should Wait Until Prices Drop.”

This is one of the biggest timing myths.

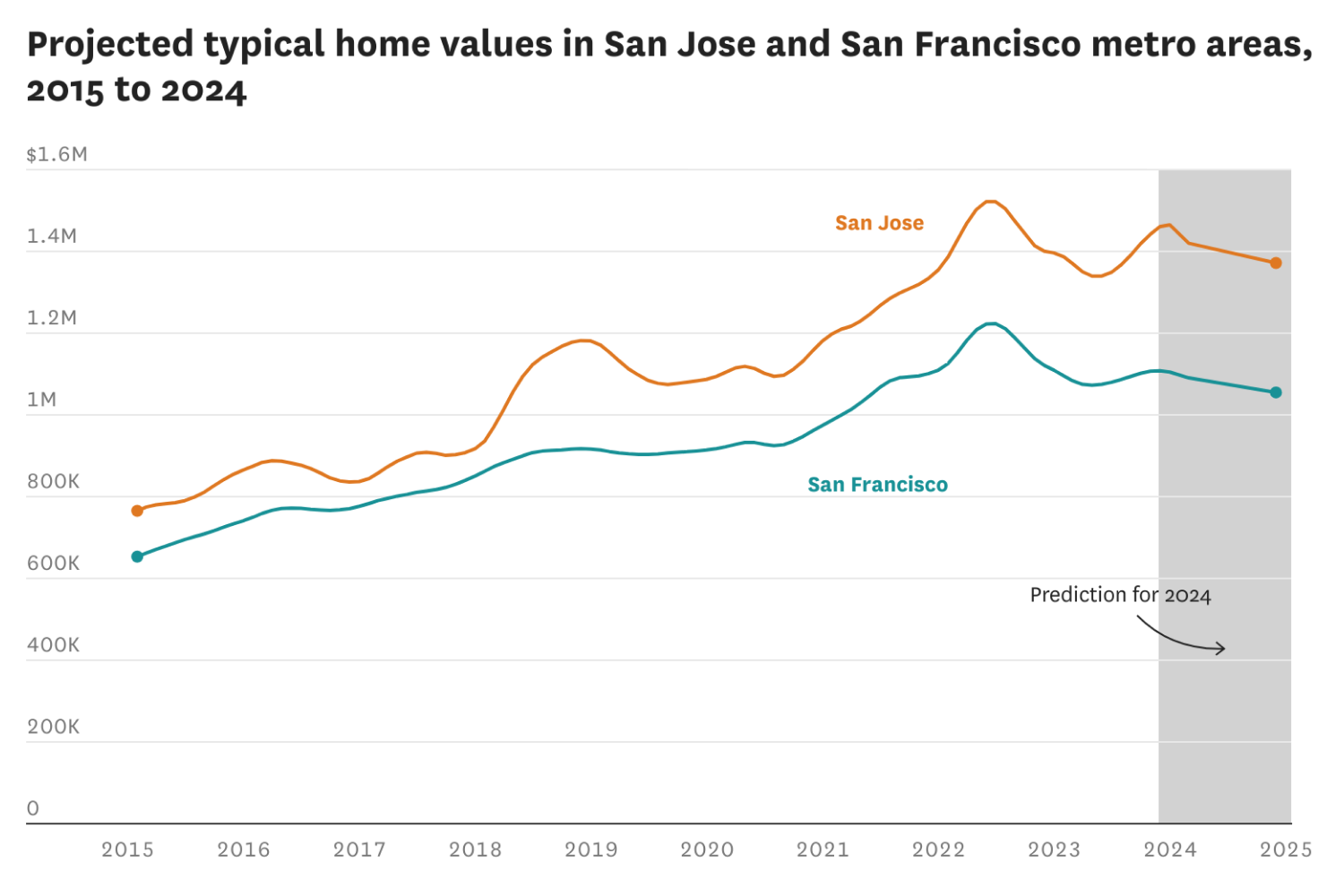

In the Bay Area, long-term appreciation has historically rewarded patience. Even during slower cycles, demand tends to return, especially in high-opportunity regions like San Francisco, the Peninsula, and parts of the East Bay.

Could prices soften in certain pockets? Possibly.

Could they rise again when rates improve? Also possible.

The real question isn’t “Will prices dip 3%?”

It’s: Does buying now support your long-term plan?

Interest Rates: The Real Story

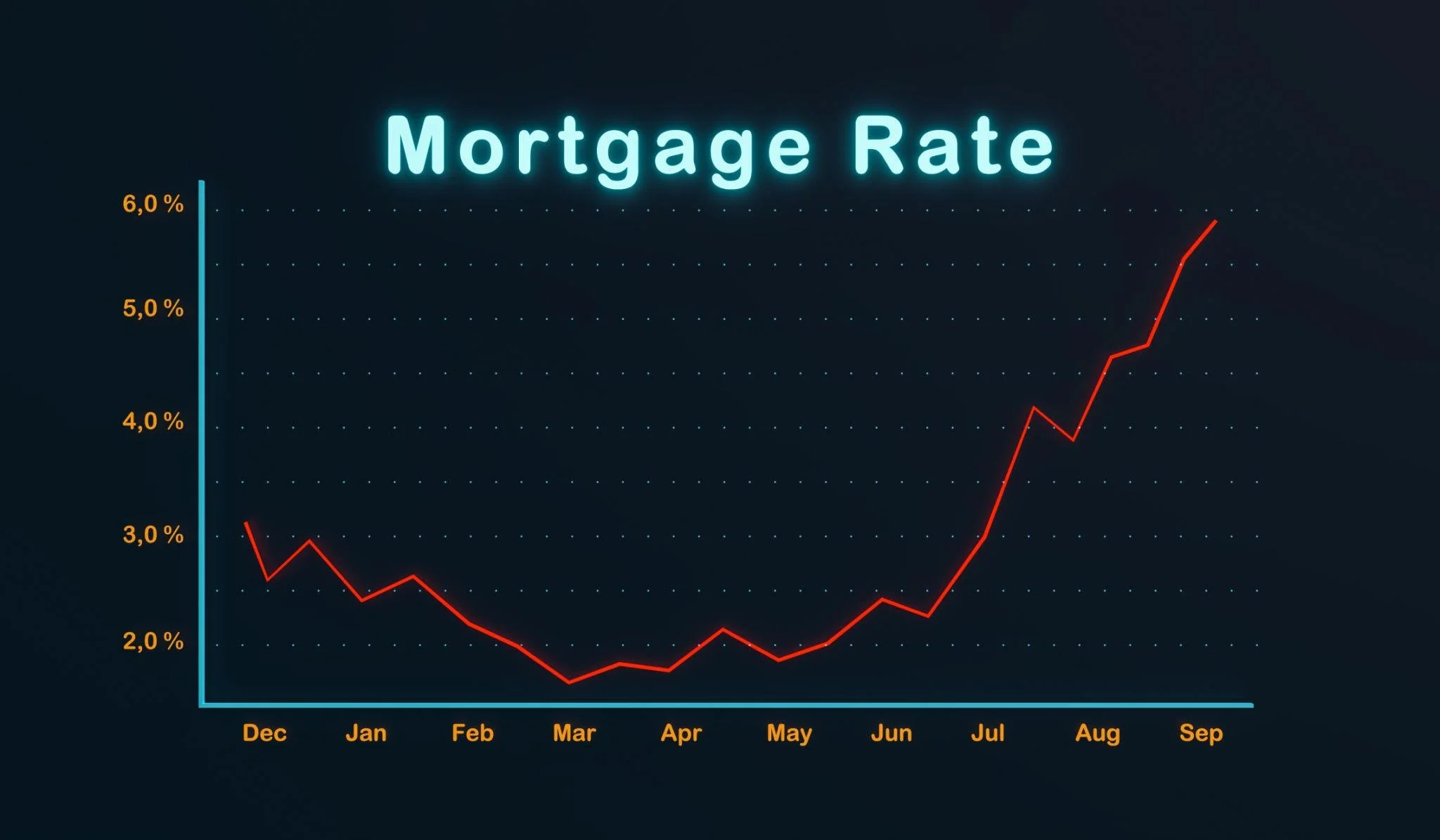

Many buyers paused when rates climbed in recent years. But here’s what’s happening now:

Rates are stabilizing compared to sharp jumps we saw before

Buyers have adjusted expectations

Refinancing later is an option if rates improve

You can’t refinance a purchase price.

But you can potentially refinance a rate.

That doesn’t mean rush. It just means rate headlines shouldn’t be the only deciding factor.

Lifestyle Timing > Market Timing

This is the part most blogs skip.

The better question isn’t “Is 2026 perfect?”

It’s:

Are you planning to stay 5+ years?

Is your income stable?

Do you have reserves beyond your down payment?

Are you ready for the responsibility of ownership?

If those answers are solid, 2026 could absolutely be a good year for you.

If they’re not, renting longer is not a failure — it’s strategy.

When 2026 Makes Sense to Buy

Buying this year may make sense if:

✔ You’re financially stable

✔ You’re planning to stay long-term

✔ You’ve saved responsibly

✔ You value stability over flexibility

✔ You’re tired of rising rent

When It Might Make Sense to Wait

It may be better to wait if:

✔ Your job situation is uncertain

✔ You’re planning to relocate within 2–3 years

✔ You don’t have emergency reserves

✔ The monthly payment feels stressful

Buying should feel like a confident move, not a pressured one.

The Bottom Line

2026 isn’t about perfect timing.

It’s about smart timing for you.

The Bay Area isn’t a short-term flip market for most homeowners. It’s a long-term stability and wealth-building region. If you’re approaching it with a 5–10 year mindset, temporary shifts matter less.

If you want to run real numbers based on your situation, not headlines, I’m always happy to talk it through. No pressure. Just clarity.

Because the best decisions aren’t rushed. They’re informed.